Selection Methodology

The following companies were selected based on three key criteria:

- Low Debt-to-Equity: below 30%

- Intrinsic Value: Currently trading below calculated intrinsic value

Top Undervalued Low-Debt Opportunities

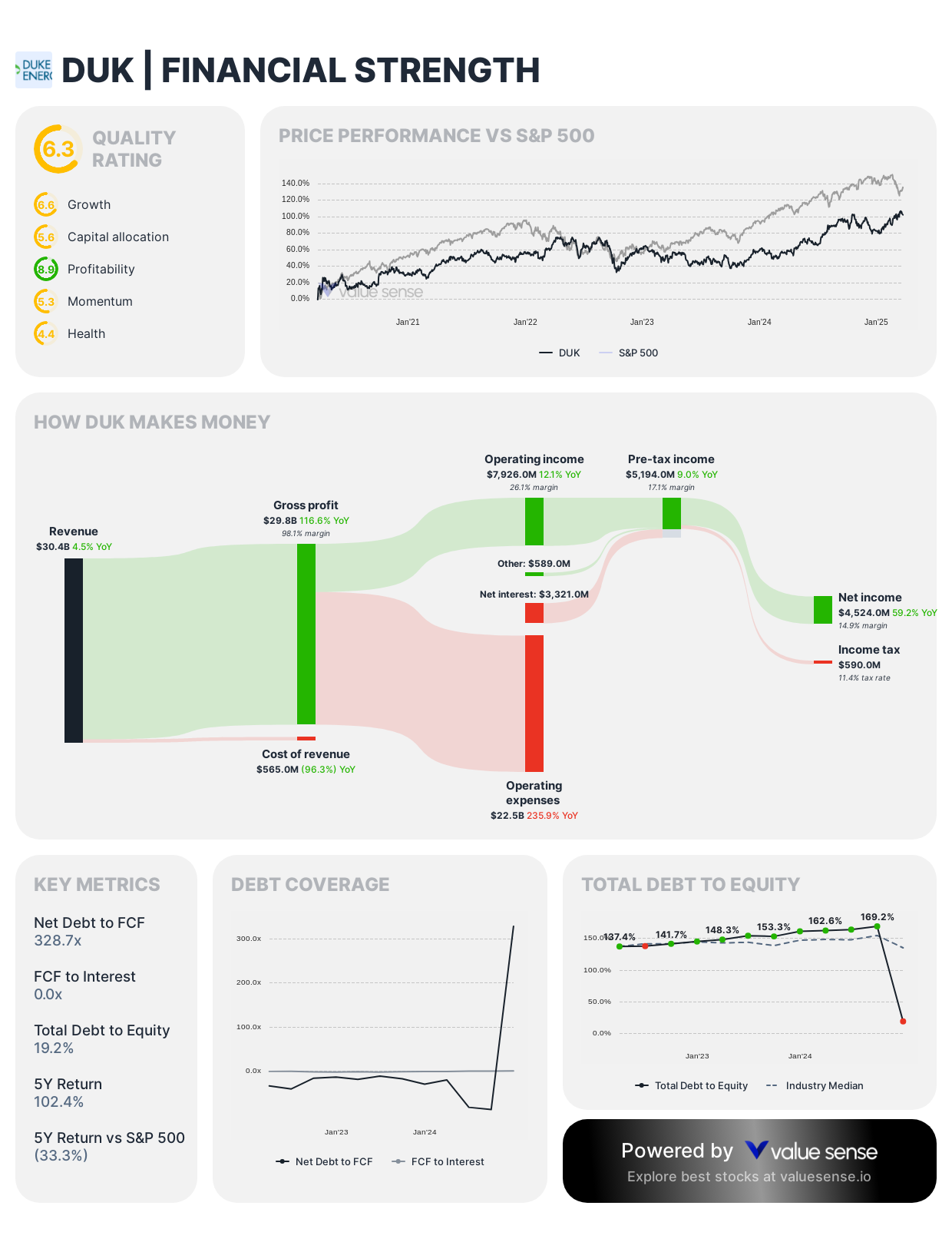

1. Microsoft Corporation (MSFT)

- Debt-to-Equity: 20.6%

- Net Debt: ($9,327.0M) - Cash positive

- Intrinsic Value: $430.1 (9.4% undervalued)

- Highlights: Strong free cash flow ($70.0B), exceptional FCF to Interest coverage (33.6x)

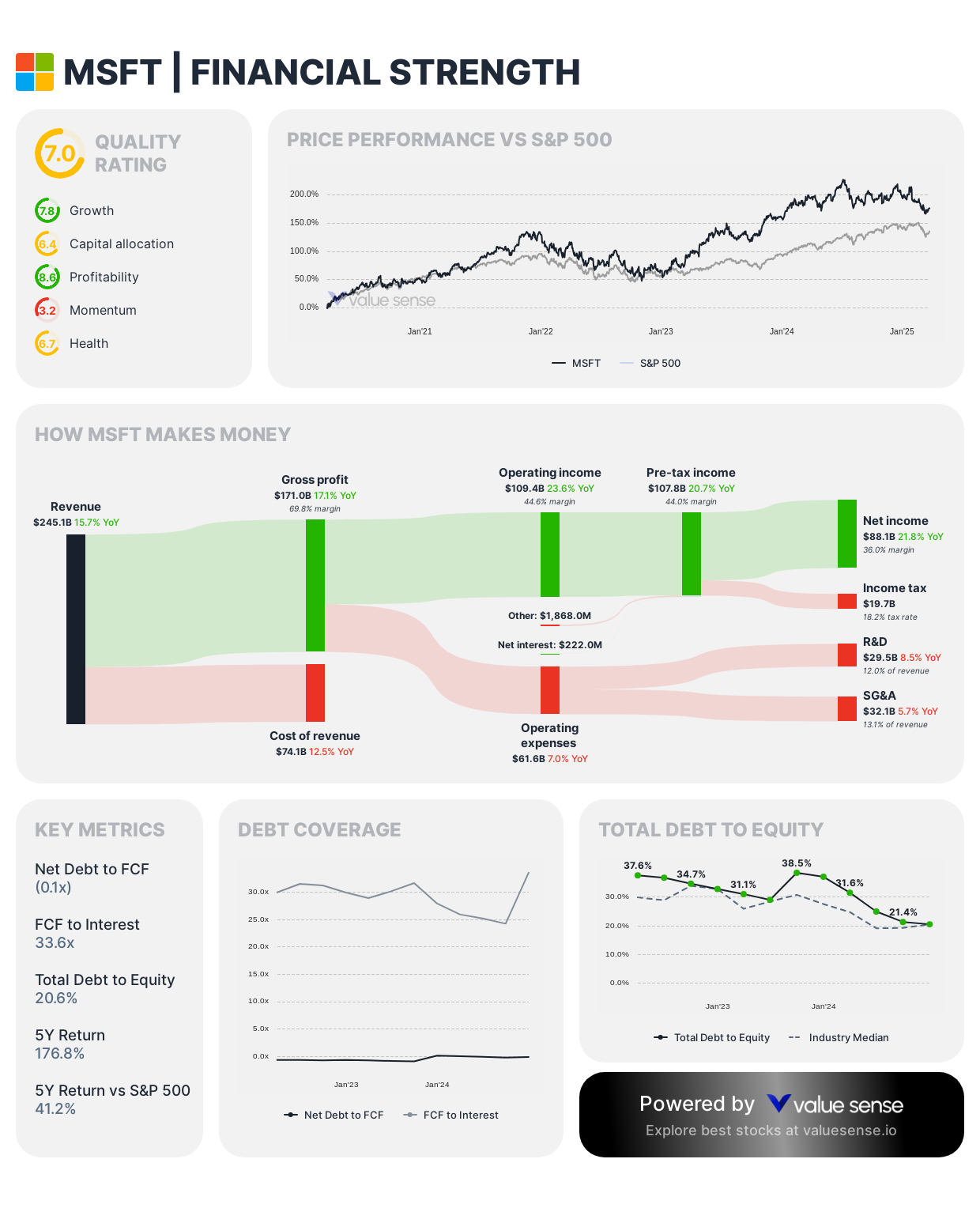

2. SAP SE (SAP)

- Debt-to-Equity: 23.3%

- Net Debt: (€587.0M) - Cash positive

- Intrinsic Value: $279.6 (1.4% undervalued)

- Highlights: Impressive 1Y return (42.5%), solid free cash flow (€4,423.0M)

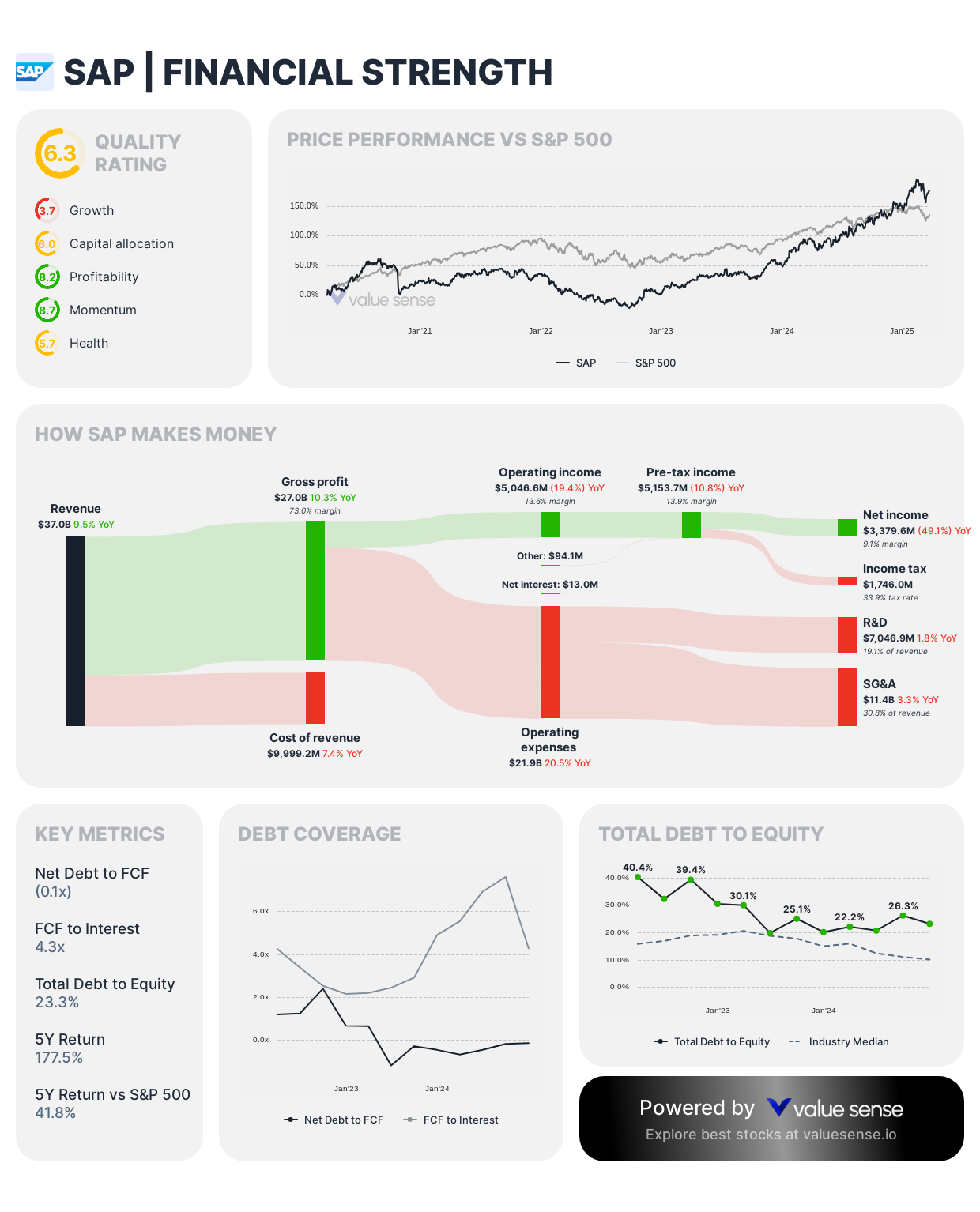

3. ASML Holding N.V. (ASML)

- Debt-to-Equity: 19.9%

- Net Debt: (€9,064.0M) - Cash positive

- Intrinsic Value: $740.5 (1.7% undervalued)

- Highlights: Strong quality rating (7.3), excellent cash position

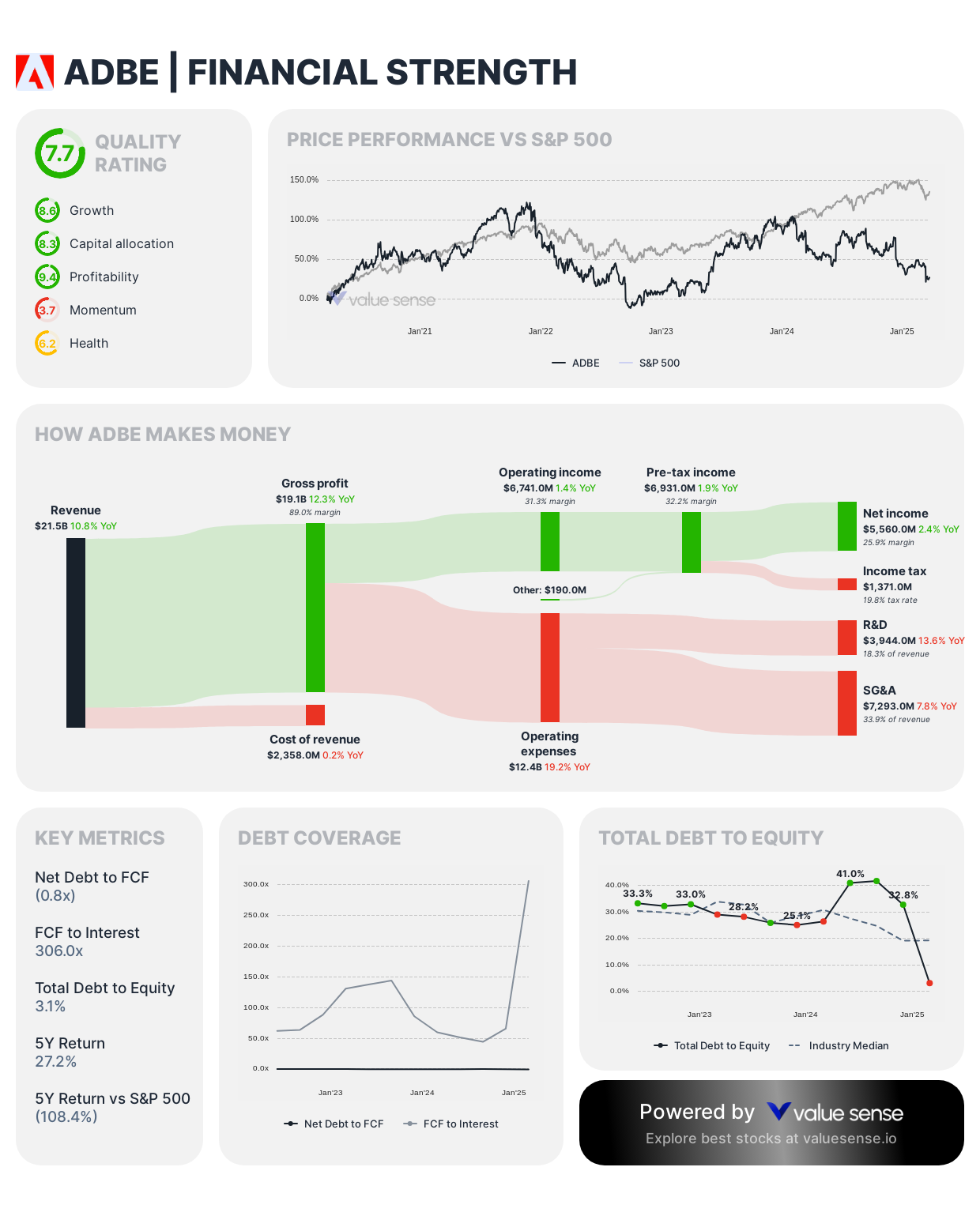

4. Adobe Inc. (ADBE)

- Debt-to-Equity: 3.1%

- Net Debt: ($7,027.0M) - Cash positive

- Intrinsic Value: $510.8 (29.5% undervalued)

- Highlights: Exceptional FCF to Interest ratio (306.0x), quality rating (7.7)

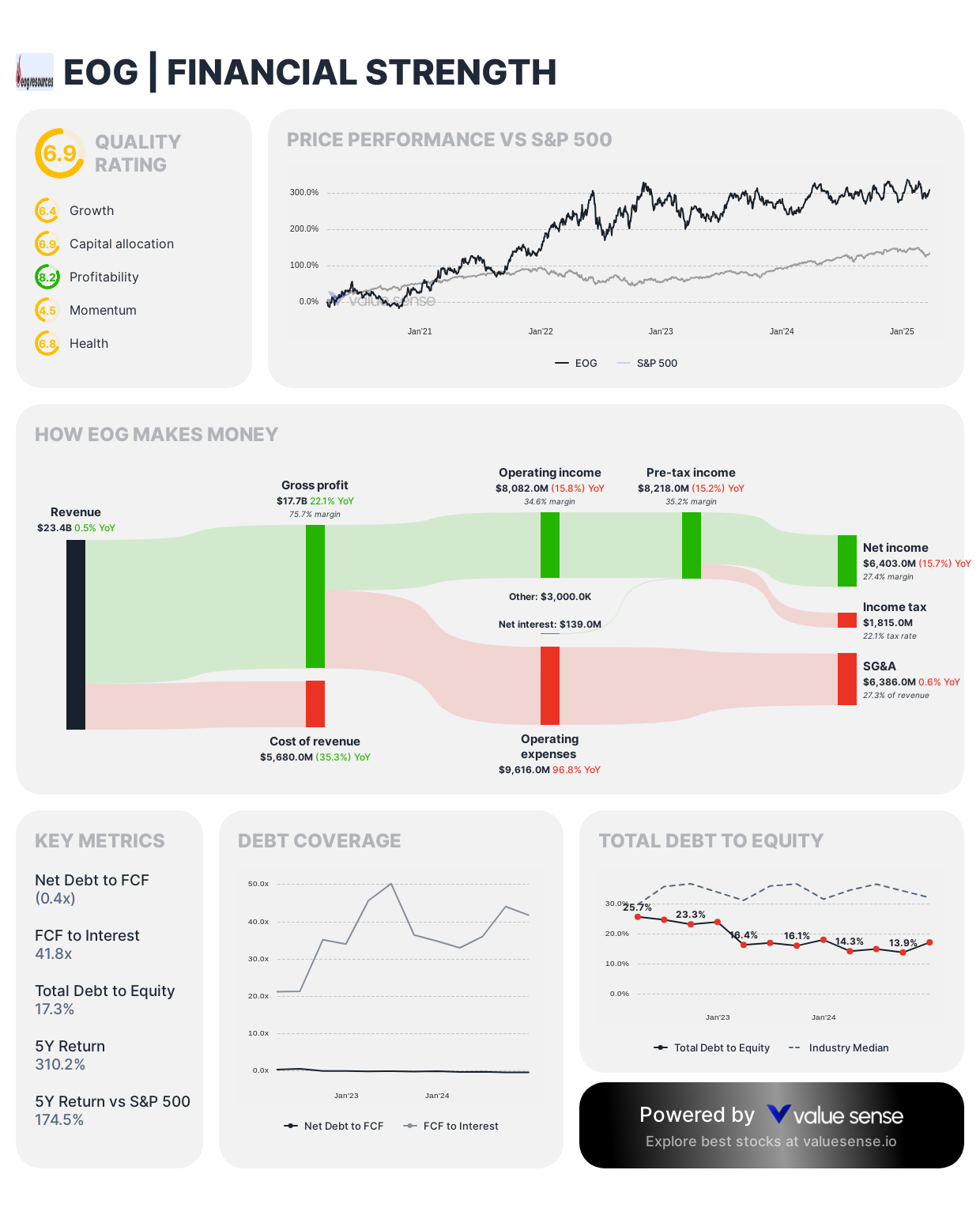

5. EOG Resources, Inc. (EOG)

- Debt-to-Equity: 17.3%

- Net Debt: ($2,025.0M) - Cash positive

- Intrinsic Value: $152.3 (18.7% undervalued)

- Highlights: Strong liquidity (2.1x current ratio, 1.8x quick ratio)

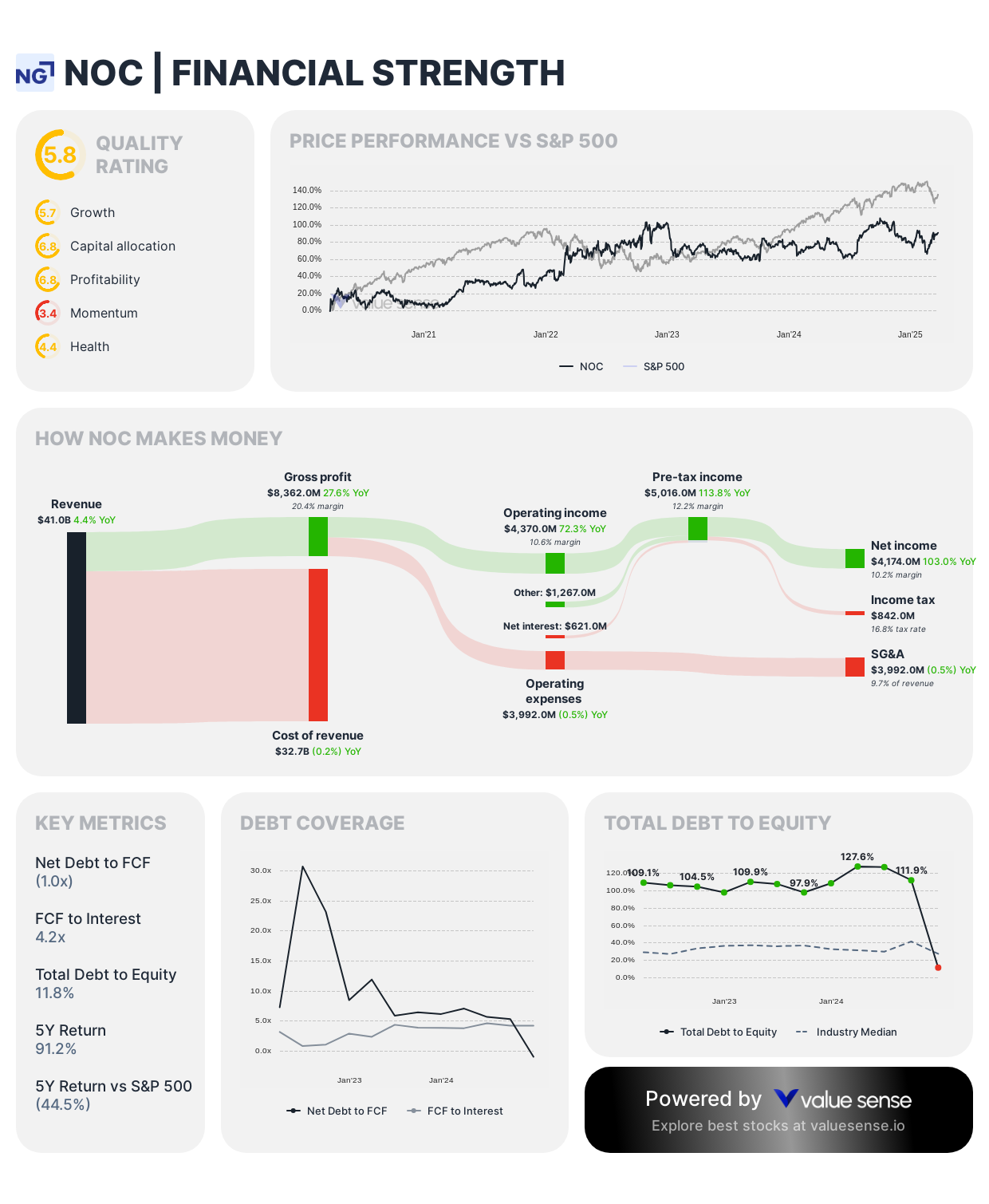

6. Northrop Grumman Corporation (NOC)

- Debt-to-Equity: 11.8%

- Net Debt: ($2,555.0M) - Cash positive

- Intrinsic Value: $701.0 (41.6% undervalued)

- Highlights: Significant undervaluation, stable revenue ($41.0B)

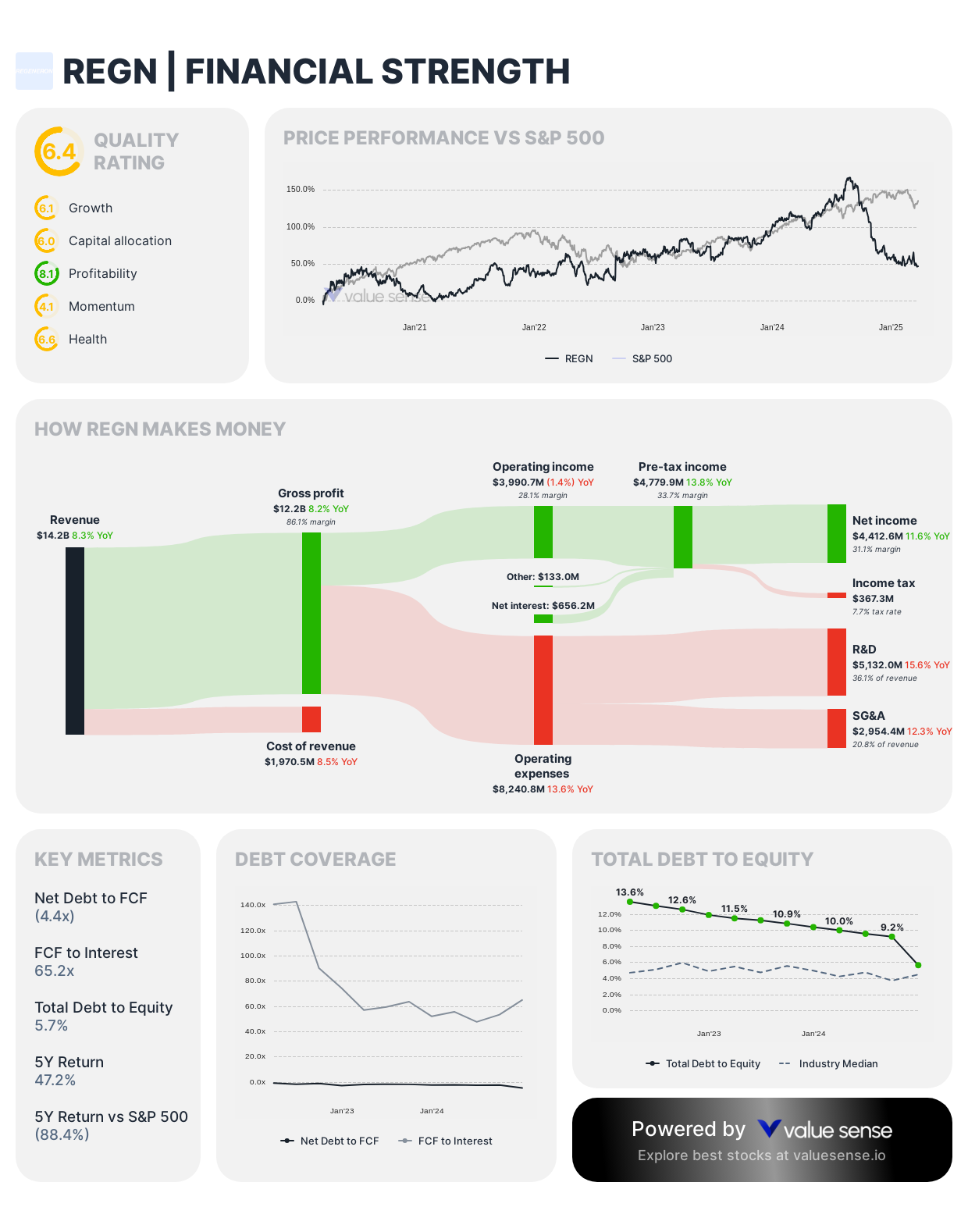

7. Regeneron Pharmaceuticals, Inc. (REGN)

- Debt-to-Equity: 5.7%

- Net Debt: ($15.9B) - Cash positive

- Intrinsic Value: $1,034.1 (56.4% undervalued)

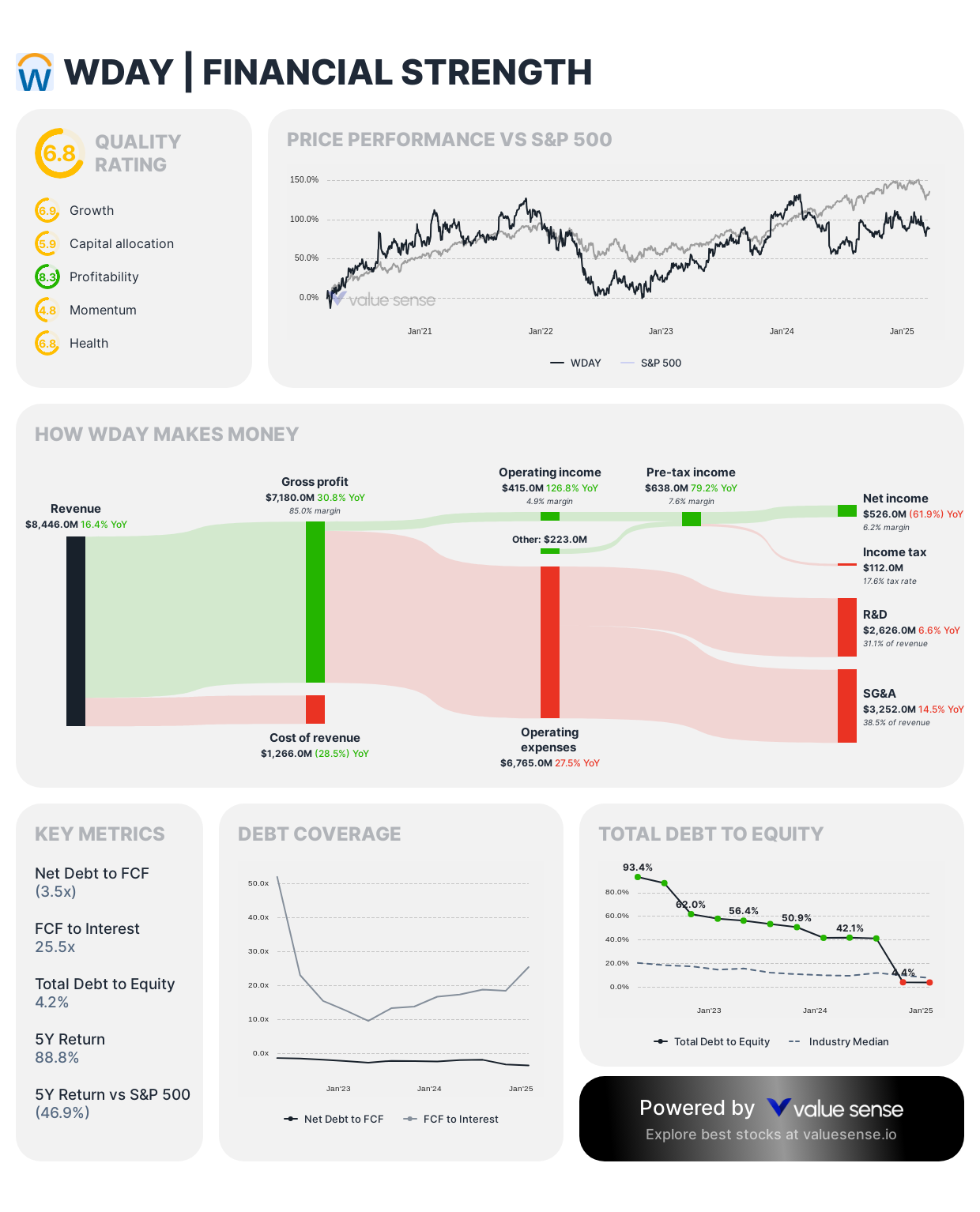

8. Workday, Inc. (WDAY)

- Debt-to-Equity: 4.2%

- Net Debt: ($7,639.0M) - Cash positive

- Intrinsic Value: $310.4 (24.2% undervalued)

- Highlights: Strong revenue growth (16.5%), solid FCF ($2,192.0M)

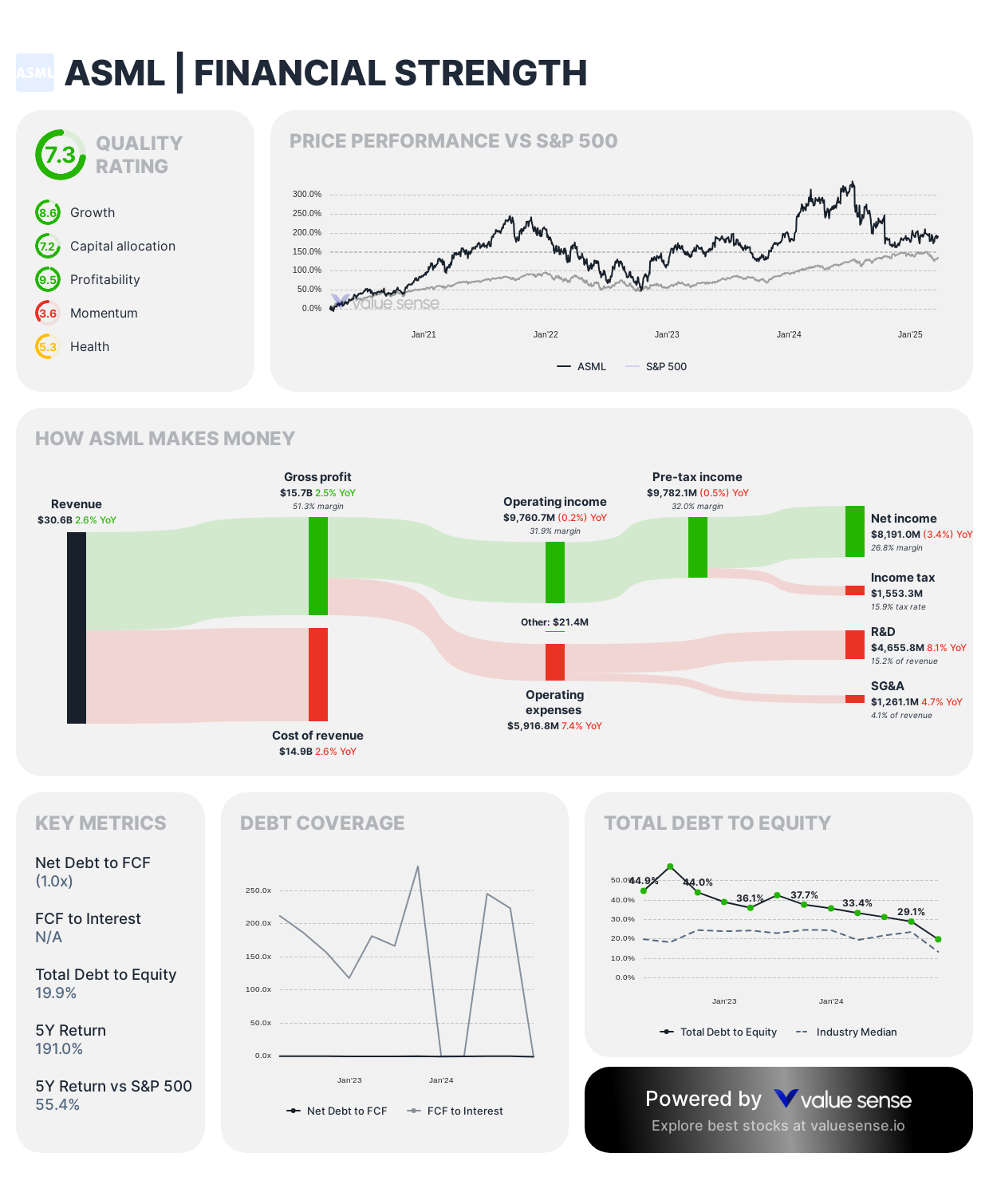

9. Duke Energy Corporation (DUK)

- Debt-to-Equity: 19.2%

- Net Debt: $9,533.0M

- Intrinsic Value: $156.4 (32.3% undervalued)

- Highlights: Stable utility business, high earnings power value (97.3% of EV)